Tanker at the Panama Canal. Ronald Kötz. 2019.

(Originally published on February 10, 2021)

For years now, there has been serious talk about an additional Atlantic-Pacific route — a second “Panama Canal” . The geopolitical juncture of the incipient decade points to Mexico, not Nicaragua, as the next interoceanic link. What are the geopolitical implications?

Seasonal Bottleneck, Structural Limits

The bottleneck of liquefied natural gas (LNG) vessels at the Panama Canal is expected to last until March 2021, according to industry traders consulted separately by Reuters and Natural Gas Intelligence. Though this infrastructural strain is partly seasonal, it also reflects the Canal’s long-term limitation to handle the future demands of international commerce and the transit of commodities.

The Canal has struggled to accommodate increasing LNG traffic, even after the completion of a decade-long expansion in 2016. In January 2021, the Canal set a new record in transits and tonnage of LNG: “58 LNG vessels transited through the Neopanamax Locks, totaling 6.74 million Panama Canal tons (PC/UMS)”, informed the Panama Canal Authority.

NATURAL GAS AND THE FOURTH INDUSTRIAL REVOLUTION

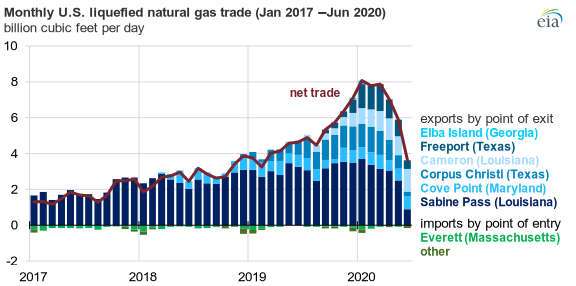

The structural transformations in the global economy as part of the Great Reset make natural gas an ever increasing part of the global energy mix as a transitional fuel off petroleum economies and into renewable energies. It is in this transition to a Green Capitalism that LNG production and exports have increased significantly in the U.S.. Most of this new export capacity is located in Gulf Coast facilities (Figure 1).

“In 2017, the United States exported more natural gas than it imported on an annual basis for the first time in nearly 60 years, making it a net natural gas exporter. Since then, U.S. net natural gas exports have more than doubled every year”, reported the U.S. Energy Information Administration on September 2020. The EIA noted exports began to abate in April 2020 due to the economic slowdown in the global COVID response, but it predicted a reverse to the fall of oil and gas production in 2022.

BOTTLENECKS AND INFRASTRUCTURE

As more LNG capacity comes online on the Gulf Coast, the energy bottleneck at the Panama Canal will continue to compound. Gonzalo De Arteaga, senior natural gas adviser at shipbroker Fearnleys AS, questioned how energy projects might be affected by the structural constraints of the Canal: how might the Panama Canal bottleneck impact gas production? Natural Gas Intelligence quoted from De Arteaga:

“Given the determination of project sponsors aiming to develop a second wave of U.S. Gulf Coast LNG export schemes, what constraints and costs will the Panama Canal impose on these projects, and just as importantly, what advantage might the projects under development on the west coast of North America enjoy over their rivals?”

Gonzalo De Arteaga, Natural Gas Intelligence

De Arteaga brings up an important line of inquiry, but taking it one step further, how might the Canal bottleneck affect other infrastructure projects in the region? For years now, there has been serious talk about an additional Atlantic-Pacific route — a second Panama Canal, but where? Routes like the Guatemalan Interoceanic Corridor and Costa Rica’s Green Interoceanic Canal have all stalled for various reasons. The geopolitical juncture of the incipient decade points to Mexico, not Nicaragua, as the next interoceanic link.

A Second Canal?

Nicaragua was the most likely location for a second canal until recently. Along with the Isthmus of Tehuantepec in Southern Mexico, it had always been a top contender for an intercontinental corridor since before the Panama location was secured in the late 1800s. It was not until 2013 that the project for a Nicaraguan Canal received backing from Chinese capital, but it was torpedoed after the main investor, HKND Group, ran aground with financial trouble.

Further, political conditions changed as protests targeted the the Sandinista administration continuously between 2014 and 2020, partly with U.S. involvement. The 2021 Nicaraguan elections and possible renewed regime change efforts under the Biden-Harris administration, carried over from the Trump presidency, further dispel any viability to revive the Nicaraguan Canal project in the near future.

THE ISTHMUS PROJECT

Further North, however, is the Isthmus of Tehuantepec, a narrow strip of land the U.S. has coveted since the 19th century (the McLane-Ocampo Treaty is an infamous antecedent). Here, the left-wing Mexican government of Andres Manuel Lopez Obrador (AMLO) is pushing forward an infrastructure megaproject likened to a second Panama Canal. This intercontinental corridor is an ambitious infrastructural enterprise of 100 billion pesos (5 billion dollars) (Figure 3). More than just two ports connected by high speed passenger and cargo rail, the Isthmus project is planned as a multimodal infrastructural network; the modernization of the existing railroad is only 20 billion pesos (1 billion dollars) of that total.

The Interoceanic Corridor of the Isthmus of Tehuantepec (CIIT) consists of three main elements: transportation infrastructure, energy projects and manufacturing hubs. It will stretch approximately 300 kilometers (186 miles), encompassing 79 municipalities across two states and linking the ports of Coatzacoalcos, Veracruz and Salina Cruz, Oaxaca. Whereas vessels often wait up to 15 days to cross the locks of the Panama Canal — a feat that takes 8 hours in itself— the CIIT railway reduces the time between both oceans to a mere 3 hours, which would make it the fastest intercontinental route in the Americas.

Manufacturing hubs, otherwise known as maquiladora clusters, are programmed along the route. These hubs are Special Economic Zones (SEZ) in all but name, as the government has officially extinguished the SEZ legal figure in its crusade against neoliberalism—at least nominally. Instead, the Corridor contemplates ten “zonas francas” or “free zones” with lower taxes and production costs, in a similar scheme as SEZ. These clusters will articulate the manufacturing industry in a region where it makes up 80% of economic activity.

Energy Extractivism

The Tehuantepec Corridor is scandalously controversial. It is a massive undertaking in the reconfiguration of territories, the reordering of economies, and the management of populations — and it is not without its critics. Together with the administration’s other infrastructure megaprojects, the Corridor is judiciously criticized on the environmental front.

In Nahuatl, “Tehuantepec” means “hill of the jaguar”, as this mainly tropical region rich in biodiversity is home to this threatened species. Naturally, environmental impacts like chemical and noise pollution; waste and contamination; habitat destruction; and ecological disruption are a grave concern.

NETWORKS OF EXTRACTION

These megaprojects have also come under fire for multimodal land grabbing; real estate speculation; and the displacement of indigenous communities. Additionally, all three projects will be interconnected as part of a network of fossil fuel extraction, regional energy distribution and intercontinental transportation of non-renewables (Figure 4). When the Dos Bocas refinery comes online, it will be strategically located to exploit 80% of the country’s petroleum reserves. This same zone holds 57% of Mexico’s gas reserves and accounts for 92% of the country’s petrochemical production, according to a congressional study.

And though the energy aspect is one of the most controversial facets of the project, it is also its greatest asset. The multimodal transportation corridor integrates existing and planned energy infrastructure like pipelines, refineries, petrochemical facilities — even hydroelectric plants and wind turbines. It will connect to the Tren Maya and the Dos Bocas port-refinery, two of the other flagship megaprojects of the current administration. Notably, the project anticipates greater LNG flows through the region and taken together, CIIT’s oil and gas pipelines will be able to transport a net 300 million barrels of hydrocarbons per day.

THE GEOPOLITICS OF TEHUANTEPEC

Geopolitically, the development projects of the Mexican Southeast represent a deepening of regional integration, in two senses. First, it brings the Yucatan Peninsula, and the Mexican south in general, closer to the historical core of the country (Figure 6). These are regions with lower living standards than the rest of Mexico, a result of historical patterns of domination and dispossession, but also of the more recent uneven neoliberal development that amplified social inequalities. Concurrently, these development projects advance North American integration under U.S terms. North American firms, Mexican labor and Mexican natural resources all nourish North American integration as the project stands.

As an entry point for the U.S., there is a possibility the Corridor might become another node in the Greater Caribbean security shield and thus boost the United States’ projection in the region (Figure 7). It cannot be forgotten that with the Panama Canal came the U.S. lease and the Panama Canal Zone… then came the 1989 invasion. That is to say, interoceanic connections of geostrategic significance generate new arrangements and tensions related to the sovereignty of the host nation.

MINIMAL RISK TO U.S. INTERESTS

Along the same lines, GRAIN, a food justice coalition, observed:

The misnamed “Mayan Train” is a national economic integration and regional redevelopment strategy. It takes advantage of the new North American Free Trade Agreement (CUSMA) to open up a pivotal area on the Yucatán Peninsula and the Isthmus of Tehuantepec across the Gulf of Mexico from the United States. It will turn the gulf into a mare nostrum, providing easy access for US interests to extract resources and impose communications, services, and goods — from industrial products to human trafficking. Access to the Caribbean and northern South America will also be expedited.

GRAIN

Despite opposition, the Lopez Obrador administration is committed to pushing these projects forward. Unlike the Nicaraguan project, the Mexican alternative poses minimal geopolitical risk to the U.S. and is therefore unlikely to be “vetoed” by it. With the backing of foreign and domestic capital, the Southeastern megaprojects continue to march forward. The Isthmus corridor is set to begin operations in 2023 and the Mayan Train is programmed to follow a year later in 2024.

Conclusions and Further Research

The reconfiguration of the Isthmus of Tehuantepec and the Yucatan Peninsula punctuates contradictions that pose uncomfortable and difficult questions. What should be the balance between national development goals and local communities’ interests? What priorities should energy infrastructure reflect? How might development agendas overcome extractive models?

There is an abundance of critique from the environmentalist opportunists — foreign correspondents and influencers abound — to grassroots activists with skin in the game. Moreover, an extensive literature exists from socially-oriented scholarly collectives (like the outstanding GeoComunes), to private institutions, academia and authorities.

However, with the notable exception of Dr. Ana Esther Ceceña’s work, there is considerably less on the geopolitical implications of the Southeastern megaprojects, making this an urgent and understudied aspect. Who will control this multimodal transportation corridor? Who will benefit from this regional development strategy? How far will the left-wing government compromise with demands of capital? How might Mexico balance a socially-just development agenda in the Southeast with the U.S. imperative to dominate the region?